Hamish Smith talks us through the best-performing brands in the vodka category at the UK's Best Bars.

For more: scotch, American Whiskey, brandy, gin, tequila, spirits.

Denuded of its marketing, vodka is the most straightforward proposition out there. Reductively speaking, it’s gin without the botanicals, whisky without barrels. Yet, in another sense, vodka’s nakedness means there’s nothing to hide behind. And so, in a sort of paradoxical sense, the simplest of spirits requires the most attention.

And that is one of the reasons – along with the category’s penchant for hyperbolic marketing – that vodkas in the UK’s Best Bars tend to lean towards super-premiumend liquids, while in the gin category, for example, the bestsellers are a rung down on the price-positioning ladder.

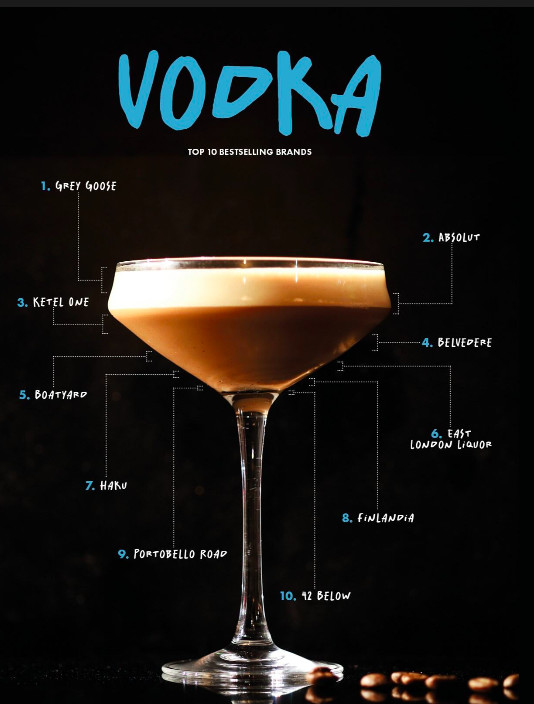

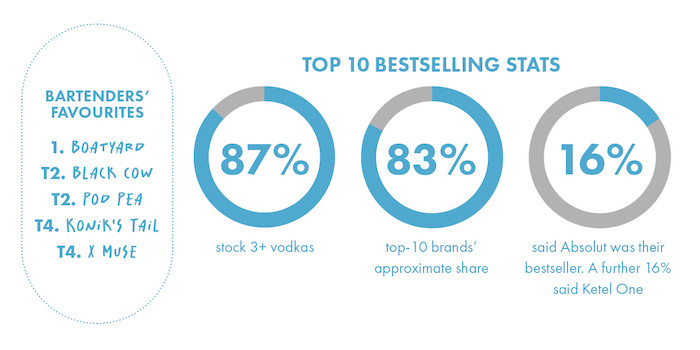

According to our research, Bacardi’s Grey Goose is the bestselling vodka in the UK’s best bars, with our data suggesting it makes up about a sixth of overall volume in this sector. It’s very much priced at the higher end of what a bar might be comfortable putting in the speed rail – 14% of our sample said it was their bestseller – but it’s a top-three vodka in 45% of bars.

Now that is coverage – it also tells you that, even if Grey Goose is not the contract pour, it’s still very much in the conversation through cocktail listings and upsells. It remains one of the industry’s most important bar calls.

In second spot is Pernod Ricard’s Absolut, which is mostly its augmented Elyx in cocktail bars. It registered a couple more house listings than the Goose in our sample of bars (16%) but where it wasn’t top dog, it was far less likely to be in the pack (a further 11% said it was among their top three).

Diageo’s Ketel One was close to mirroring Absolut’s numbers. It is another brand with designs on the house pour, but not so interested in playing second (or third) fiddle.

LVMH’s Belvedere dropped from third to fourth this year – we’ll have to see if that’s its long-term standing (we’re only two years into The Class Report), or whether there’s some volatility in our data. It was the bestseller in 7% of our bars but, perhaps because of its peppery point of difference, it was found to be a real favourite outside of the well (28% said it was second or third choice).

Vodka production may not be a tradition of the British Isles, but it still seems curious that the bestsellers are from France, Sweden, The Netherlands and Poland, particularly when you consider how much spirit is produced here.

Enter Northern Ireland’s Boatyard, which is very much a grain-to-glass offering, with organic Irish wheat producing an unfiltered vodka that bartenders have fallen for – it’s once again top of our Bartenders’ Favourites list. Pricing wise, it’s flying in formation with Grey Goose, though doesn’t quite have the financial muscle to compete on house pour (5% of our sample). For brands this size, cocktail listings are key – it was a second or third bestseller in 17% of bars.

East London Liquor’s vodka – made from British wheat – is a few rungs down the price ladder and has a real concentration of sales in the capital. More suited to the rail, it was the bestseller in 8% of our sample, the number two in 3%, but wasn’t really a supporting act proposition.

Suntory’s Haku, made with rice, seems to be stuck between two approaches – competing for volume but being a little pricey for a brand without the consumer recognition of the likes of Grey Goose. It was a top-three vodka in 14% of bars.

While Finlandia is a survivor of a former time, when value-for-money vodkas were prized by bartenders, it still has a following – 11% said it was among their top three. The data thins from here, with Portobello Road and 42 Below both picking up a few house pours in our sample.