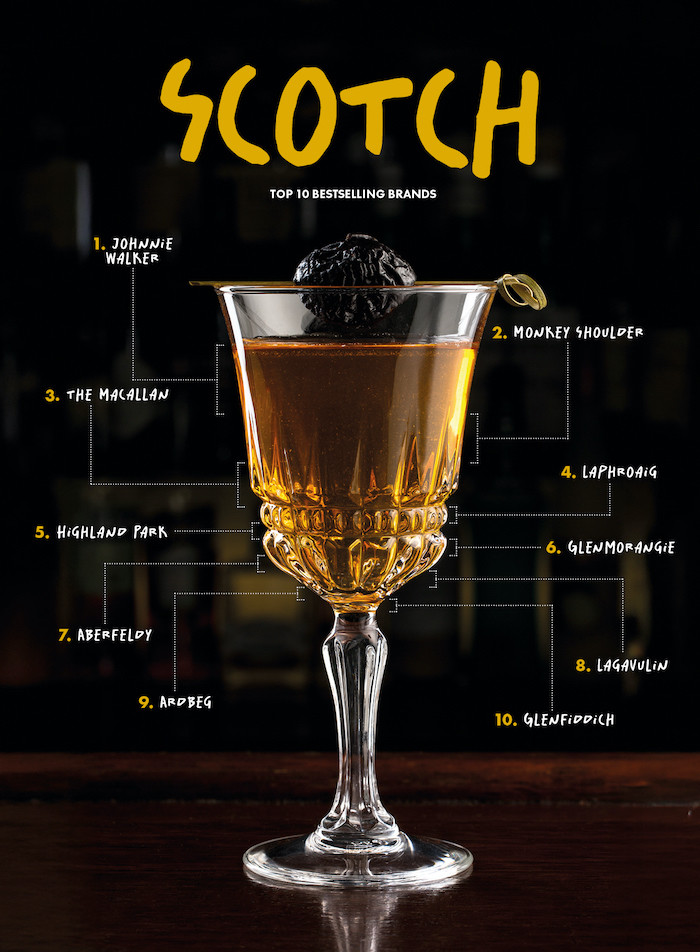

Scotch is the latest category under the spotlight in our serialisation of The Class Report.

Scotch and cocktails have always been slightly reluctant dance partners. That’s partly out of anachronism – still to this day the idea that scotch is above the likes of ice, fruit and modifiers clings to life.

Utter piffle, yes, but traces of that thinking have bunked the bar over the centuries – very few classics in circulation call for scotch.

There’s just one in this year’s Top 50 Classics list – the Penicillin is popular, but for scotch sales it’s no panacea. Despite hailing from Britain, scotch is in fact only the sixth most used spirit in the UK’s best cocktail bars. The reason isn’t all tradition, it’s in part economics.

This here category, with its exacting production standards and rules around ageing, not to mention fancy packaging, is expensive – it can be twice the price of your key mixing spirits, gin and (young) rum. Scotch is a natural-born GP killer. So what to do?

Here’s Johnnie! Yes, Diageo’s big blend combines agreeable quality at a more-than-agreeable price point – ex-VAT we’re talking £20 a bottle for Johnnie Black.

In an otherwise fragmented and malt-dominated landscape, it’s the most common scotch in bardom. 18% of our sample said Johnnie Walker was their number-one choice and almost a third of bars said it was among their three most poured.

Competing for the rail is the blended malt Monkey Shoulder, which is designed to zero in on the mixing occasion, providing a robust backbone to many a cocktail. William Grant & Sons’ scotch is the top seller in about 15% of bars and is one of the three most-called-on in a quarter.

From blended malt to the single malt The Macallan, which has positioned itself with much success at the luxury end of a luxury category. 10% of our sample of the UK’s best bars said it was their top scotch tipple and almost a third said it was among their most-poured three.

A lot of the action would be in measures rather than mixing, but this is a brand that finds its way into cocktails too, particularly in hotel bars, which make up about 10% of our pool of respondents. And let’s not forget that consumer recognition of The Macallan is so great that if you’re a swanky bar and you don’t stock it, it’s a you, not a them, problem.

From here the category rather fragments, with Suntory Global Spirits’ Laphroaig – an iconic brand with a unique flavour profile and purpose – heading a list of well-known single malts owned by larger groups. New to the top 10 this year are Edrington Group’s Highland Park and Diageo’s Lagavulin, which join reappearing Glenmorangie and Ardbeg of LVMH, Bacardi’s Aberfeldy and William Grant & Sons’ Glenfiddich.

Our data suggests the individual footprint of each of these brands is low in this channel – each controlling about 3-4% share of the market – so we won’t construct a grand narrative around them other than to say they’re all single malts that enjoy a high level of visibility and are regularly brand called accordingly. And that there are three smoky malts among them – be it for floats or sprays, or just served neat, bartenders have always had a penchant for peat.

Our Bartenders’ Favourites list – in which we put sales to one side and ask only their personal preference – reveals no clear winner, with Bruichladdich, Compass Box, Glendronach and The Macallan all tied, followed by Ardbeg.