Hamish Smith introduces the first Class Report with an outline of the thorough process undergone to ensure that the polling reveals the sales insights of the UK’s best bars.

Like so many of our editorial projects, we didn’t approach this with a fully formed product in mind but instead a question we wanted to answer: what brands do the best bars in the UK use? From there we worked backwards.

First, we had to work out how we’d arrive at the data – to collaborate with an agency or generate our own? Most spirits sales data seems to bias mainstream venues, with data companies looking at volume across all manner of establishments – bar chains, restaurants, pubs, hotels. Those that narrow in on bars fail to narrow in much further. Not all bars are created equal.

They deliver big-picture insight, but they don’t tell you much about the buying behaviour of the best bars in the UK, the end of the market that Class operates in and the source of trends that broaden out into the mainstream.

Which are the UK’s best bars?

The question then becomes, if we were to try, how would we best define the best bars in the UK? Well, we have something we prepared earlier; it’s called the Class Bar Awards. We know exactly which bars the industry considers the best.

So our first step was to populate our panel of bars with those that received votes in the Class Bar Awards in recent years, so as to form the bulk of our potential respondents. But that still left a few spaces in our team – primarily newer bars that have yet to make their mark in the recognition game. To solve this, we took any bar that our team of reviewers rated 7-10 out of 10 (FYI: review scores are hard earned in Class) and added them to the pool of invitees.

Looking at it, that just left a few blind spots. It occurred to us that there are bars out there that are known for their quality, that are either geographically isolated, or that have fallen out of the limelight. These, though relatively few in number, joined the pool of bars under the eligibility banner of Editor’s Picks.

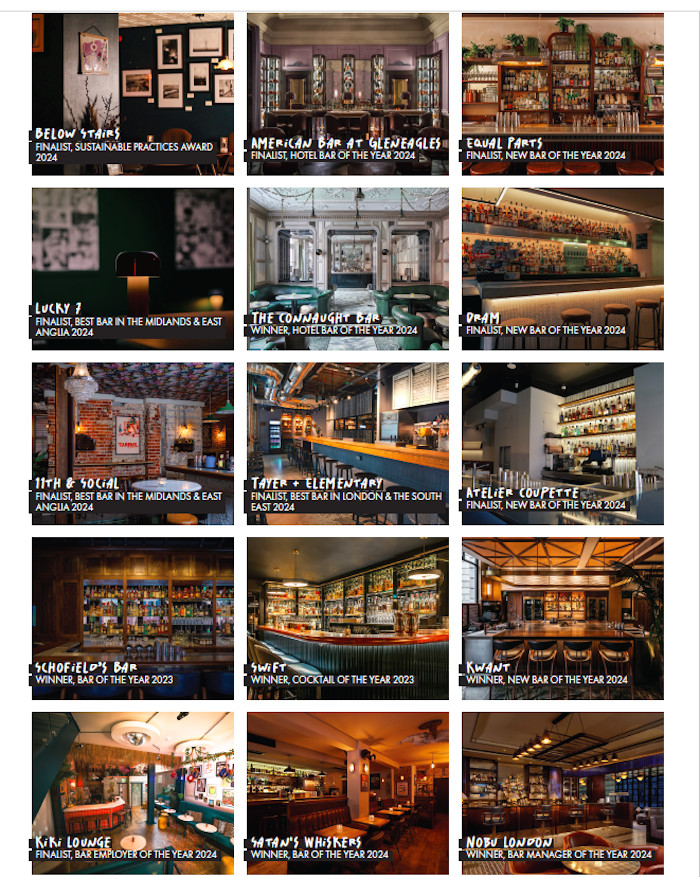

So, there you have it, an invitation list of great bars numbering into the several hundreds. To your right is a selection of some the bars that took part.

The poll

Pictured: a sample of the bars we polled

In our first year, we didn’t want to make the survey one that was so comprehensive it made bartenders apprehensive to take part. But we wanted to get an idea of the volumes sold in the channel.

We soon found out that bars can’t easily extract bottle-by-bottle data for everything they sell – or it takes longer than is reasonable to ask – so we ran a smaller pilot poll to gain an understanding of the volume difference between a bar’s bestseller, its second and its third most-sold product. This would then inform a weighting which we could apply to the main, more simply constructed survey, which only dealt in a bar’s top-three bestselling spirits in each category.

So which categories? In the first year, we chose what we thought were the 10 key categories: gin, tequila, vodka, rum, American whiskey, mezcal, scotch, brandy, liqueurs and mixers. This number will grow as the survey does, but for now, it’s the bulk of what bars sell. Once we had data on each bar’s top-three sellers, we were able to create category lists of brands, ordered by weighted data.

We didn’t only want to get an idea of the bestselling brands, we wanted to also see if there was a difference between what bars sold and what brands excited them. There was – so we created a smaller list called Bartenders’ Favourites and limited it to three brands. Where the bestselling list would likely feature bigger established brands, this secondary list would be a nod to the liquids bartenders love, regardless of price, value, customer familiarity or financial incentives. Who knows, these could be the bestsellers of the future.

Beyond brands

Brands are the major thrust of the Class Report, but we also wanted to know about the spirits categories the UK’s best bars sell the most of and what classic cocktails are made most too. So we asked bars to list their three bestselling spirit categories and their top-five cocktails, then weighted them as before. This data helped us to assemble a top-10 spirits list and a top-30 one for classic cocktails.

So that’s the Class Report in its first iteration. It’s not definitive, it's not absolute, but it’s our first attempt at providing a snapshot of the market at its most influential end – the UK's best bars.